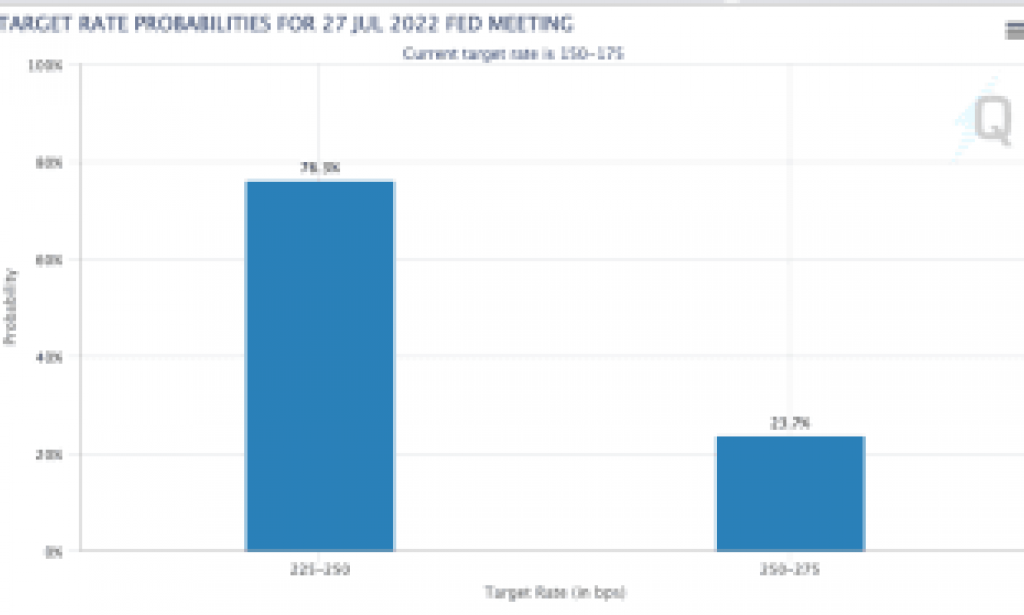

On July 27, 2022, the Federal Reserve proceeded with another 75-bp rate climb. This was comprehensively expected going into the gathering, with the market doling out a 76.3% likelihood of a 75-bp climb one hour before the gathering, with a (formerly) 23.7% possibility of a 100-bp (1.0%) rate climb occurring. After the gathering and public interview, the most recent market information puts the most ideal chances on 100 bps of climbing passed on to do before the year's over, across three more FOMC gatherings.

Going into the gathering today, resources like values and bitcoin were climbing pair, as the assumption for a timid and unbiased Fed comparative with earlier gatherings expanded financial backers' craving for risk.

Values and bitcoin climbed pair on the declaration

How about we return to the FOMC meeting and the remarks made by Powell. Here are the absolute most eminent remarks all through the question and answer session:

"The work market is incredibly close, expansion is unreasonably high."

"We assume we really want a time of development underneath potential to make a little room to breath."

"We don't think we must have a downturn."

"Our reasoning is that we need to get to decently prohibitive level by end of this current year… that implies 3% to 3.5%."

"Almost certainly, the full impact of rate increments has not been felt at this point."

"The Fed wouldn't hold back on a bigger move [rate hikes] if need."

"We are searching for unquestionable proof expansion descending over following couple of months."

"Speed of rate increments will rely upon information."

"Having a development slowdown is important."

"We assume we really want a time of development beneath potential to make a little leeway [in the work market]."

"I don't think the US is right now in a downturn."

"Nobody should rest assured on whether we can accomplish a delicate landing."

The remarks from Powell that were especially eminent were the deserting of Fed forward direction as future rate climbs, which is a shift from earlier Fed gatherings. This activity gives the Fed the adaptability to turn if/when required from now on, which was clearly a positive sign for business sectors over a shorter period of time.

Looking further forward from past the present gathering, the familiar saying of "Don't Fight the Fed" actually turns out as expected, and notwithstanding the more bullish result being picked today (a 75-bp climb instead of a 100-bp climb), the outcome for monetary economic situations is as yet net fixing, which will probably carve out opportunity to be felt by business sectors.

Long haul financial backers and more dynamic gamble supervisors the same would do best to evaluate the likelihood of a record-breaking base being set up for values and crypto markets, or rather on the off chance that this is one more bear market rally.

You must be logged in to post a comment.