💸 Finelo Review — Real Investment or Sugarcoated Scam Trap for Seniors?

1. Introduction

Not long ago, I came across an online program called Finelo, which claims to be a financial investment platform designed especially for people over fifty years old. Its advertisements make it sound like a safe and stable opportunity for older adults to grow their retirement savings.

But after digging deeper into what Finelo actually is and how it works, I discovered that this “senior-friendly” program might actually be a high-risk financial trap disguised as a stock investment system.

Let’s go through what Finelo really does, how its money system works, and why you should think twice before trusting your hard-earned money to this so-called “investment for the over-50s.”

2. What Finelo Is All About

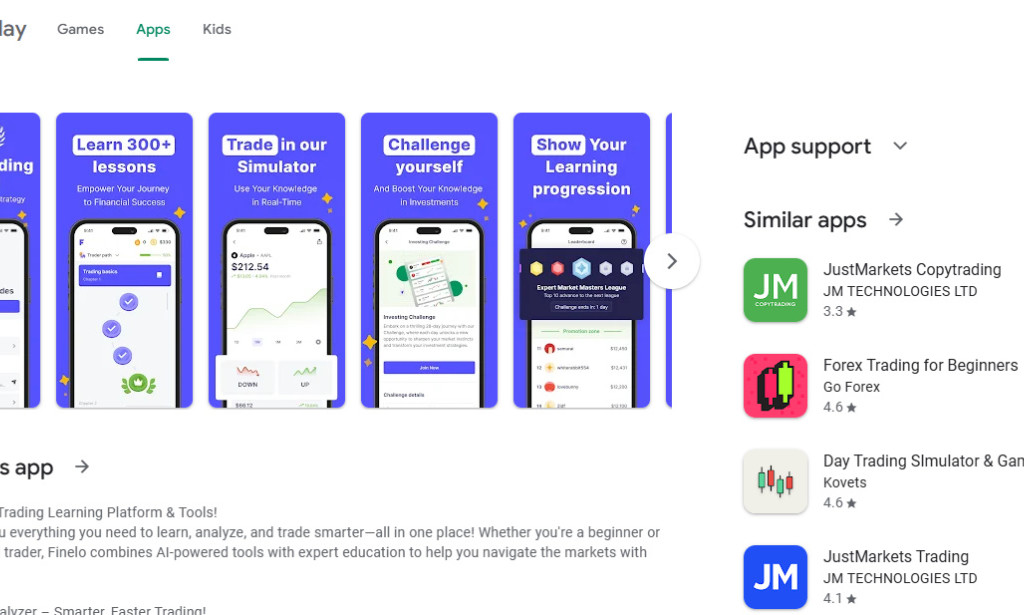

Finelo describes itself as a financial trading and investment program that supposedly helps older individuals participate in global markets. In simple terms, it’s a stock exchange-style platform where users buy and sell “shares” or “contracts” that are said to rise and fall in price, similar to real-world trading.

However, beneath this neat presentation lies a darker truth — Finelo is essentially a gamble. You’re not buying real company stocks like you would on legitimate exchanges such as NASDAQ or NYSE. Instead, you’re depositing money into Finelo’s private trading system, where prices and profits are entirely controlled by the platform itself.

3. How It Works

Finelo’s process seems straightforward on the surface:

-

You create an account and complete a “risk-free registration.”

-

You’re then asked to deposit funds — often starting from $100 or more.

-

You can “invest” in their digital assets, commodities, or stock pairs.

-

They promise you’ll earn daily or weekly “returns” depending on market performance.

But the system works only because you put in real cash. Once your money is in Finelo’s system, you’re no longer in control of it — they are. And since the platform itself determines the “rise” and “fall” of share prices, they can easily manipulate your results, ensuring you lose more often than you win.

This makes Finelo less like an investment and more like a casino disguised as a financial app.

4. CEO / Developer Information

When searching for Finelo’s CEO or company registration, there are no verifiable corporate records.

-

No registered address.

-

No names of founders or executives.

-

No license from any financial authority such as the FCA (UK), SEC (US), or CySEC (EU).

Most of Finelo’s contact information leads only to anonymous emails or Telegram groups. That’s a major red flag for any platform that handles people’s real money.

If Finelo were truly a licensed financial platform for investors over 50, it would have public company data, audit reports, and legal oversight — all of which are missing.

5. Source of Income – How Finelo Makes Money

Finelo doesn’t earn money from real market trading. Instead, its main source of income is user deposits.

When you “invest,” your money becomes part of Finelo’s system. They claim to use it to trade, but in reality, they often use new deposits to pay old users, a pattern typical of Ponzi-style operations.

Eventually, when there are not enough new deposits coming in, withdrawals become “delayed” or “under review,” and users can no longer access their money.

That’s how many high-risk trading scams collapse.

6. Referral Program

Finelo also has a referral bonus system, where users earn commissions for bringing new investors. This gives the illusion of extra income — but it’s just a tactic to expand their deposit base.

When you invite someone, you might earn a small bonus (for example, 5%–10% of their deposit). However, when the platform eventually fails or stops paying, everyone loses — including you and the people you invited.

That’s why referral-based trading platforms are extremely risky: they depend on constant recruitment rather than legitimate financial activity.

7. Withdrawal System and Payment Methods

Finelo usually claims that withdrawals are processed through bank transfers, crypto wallets, or payment gateways like PayPal. But most user feedback shows:

-

Withdrawals are delayed for weeks or months.

-

Some are completely denied after repeated requests.

-

Others receive fake confirmation emails without any actual payment.

In many cases, once you try to withdraw a large amount, your account may be suspended for “suspicious activity”, effectively locking you out of your funds.

This pattern matches other high-risk investment frauds that use the same withdrawal excuse system to prevent payouts.

8. Red Flags 🚩

-

No license or financial regulation. No proof that Finelo is registered with any government financial authority.

-

Anonymous ownership. No clear CEO, company, or office.

-

Unrealistic returns. Promises of “steady daily profit” are mathematically impossible in volatile markets.

-

Fake senior targeting. Using the “for people over 50” line to appear safe and trustworthy.

-

Manipulated trading system. Prices and profits are controlled by the app, not real market data.

-

Withdrawal issues. Multiple user complaints about frozen accounts and rejected payments.

These red flags clearly suggest that Finelo is not a legitimate investment company, but a risk-heavy trading scheme meant to pull in deposits from unsuspecting users — especially retirees.

9. What Real Users Are Saying

Across social media, Finelo users report:

-

“They promised stable earnings for retirees, but I lost everything.”

-

“Withdrawal pending for 3 months — no reply.”

-

“The so-called advisor convinced me to invest more before I could cash out.”

-

“Once I stopped depositing, my profits suddenly disappeared.”

No verifiable payment proof or real success story exists from any credible investor. Most reviews come from referral marketers who earn commission from promoting the app, not from actual profit.

10. Alternatives — Try Lodpost.com Instead ✅

Instead of risking your money on uncertain “investment programs” like Finelo, you can build a real online income safely through Lodpost.com — a legit platform for content creators and writers.

-

💰 Sign-up bonus: $0.25

-

✍️ Write and publish articles to earn per view.

-

💵 Minimum withdrawal: $10

-

🌍 Payments: PayPal, Crypto, or Bank transfer

-

📊 No investment required, no trading risk.

Lodpost rewards users transparently through ad revenue sharing — not gambling or fake market movements.

If you want real, consistent earnings, write and publish unique content instead of risking your retirement savings on unverified platforms like Finelo.

11. Final Verdict – Is Finelo Real or a Scam?

✅ Verdict: Finelo is a high-risk, unlicensed trading platform that behaves like a scam.

It targets seniors by pretending to offer a safe “retirement investment,” but in reality, it operates without any regulation, transparency, or payment proof. All deposits are at risk, and withdrawal issues are common.

Finelo’s structure resembles a Ponzi or manipulated trading program, not a legitimate financial market. Protect your funds and stay away.

If you truly want a secure, zero-risk way to earn online, use Lodpost.com, where you can earn real money through creativity and effort — not fake trading systems.

⭐ Rating Summary

| Category | Score (out of 5) |

|---|---|

| Transparency | ❌ (0.0) |

| Safety | ❌ (0.0) |

| Profitability | ⭐ (1.0) |

| Withdrawal Reliability | ❌ (0.0) |

| Overall | ⭐ (1.0) — Not Legit, Avoid |

You must be logged in to post a comment.