FirstBank Naira MasterCard Now Works Internationally: Here’s Everything You Need to Know

Good news for FirstBank customers in Nigeria! FirstBank has officially lifted the international transaction restriction on its Naira MasterCard, meaning you can now use your card to make purchases on international websites and platforms without needing a dollar card or domiciliary account.

This change is a big relief for customers who, in recent years, were unable to use their Naira cards for global transactions due to Central Bank of Nigeria (CBN) restrictions.

Background: The Previous Restriction

A few years ago, Naira debit cards from Nigerian banks were restricted from working internationally because of foreign exchange challenges. Customers were limited to local spending only, forcing them to open dollar accounts or seek alternative payment methods for international subscriptions, online shopping, and other cross-border payments.

What Has Changed?

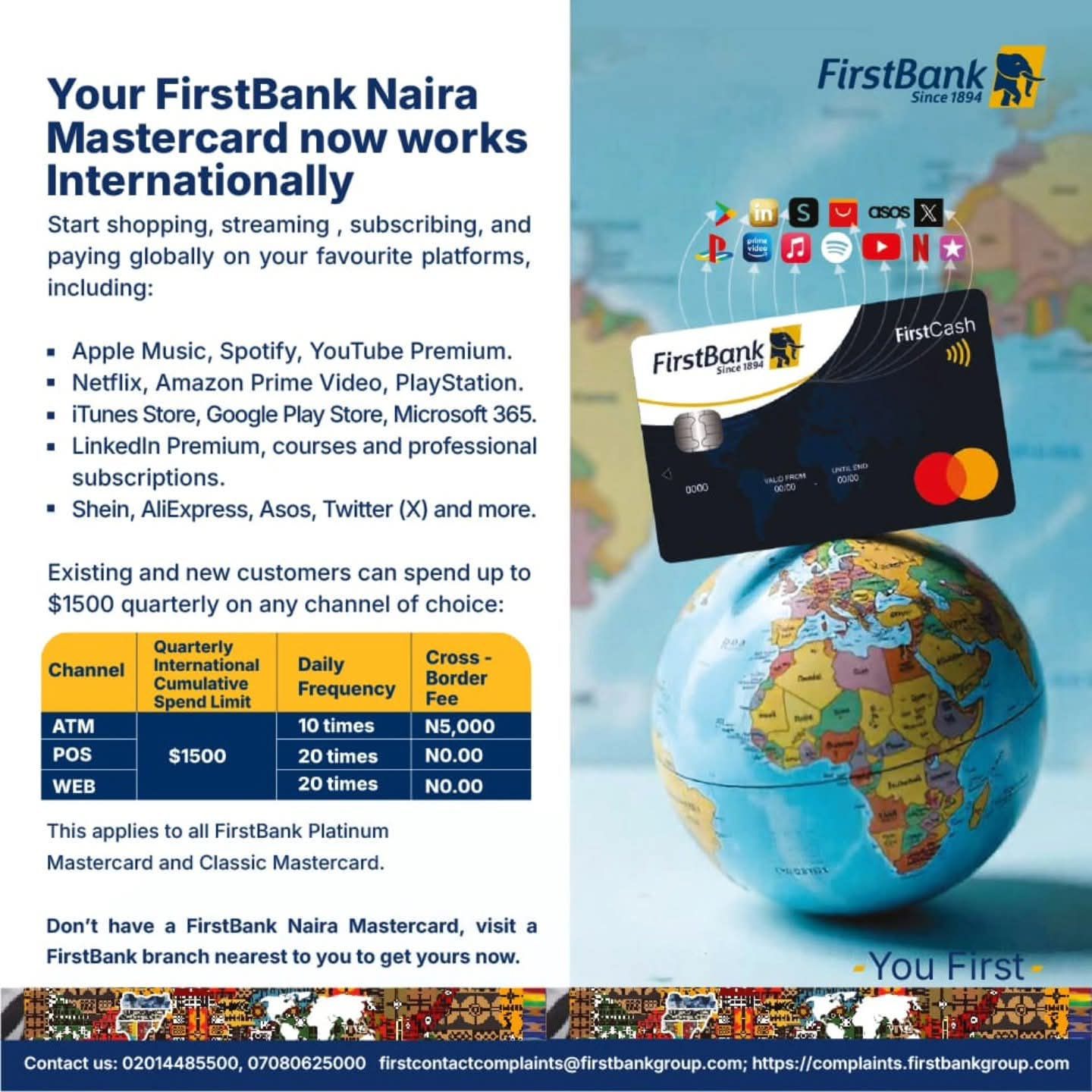

FirstBank has announced that its Platinum and Classic Naira MasterCard can now be used worldwide for online, POS, and ATM transactions.

-

You can now shop, pay, and subscribe on platforms like:

- Apple Music, Spotify, YouTube Premium

- Netflix, Amazon Prime Video, PlayStation

- iTunes, Google Play Store, Microsoft 365

- Shein, AliExpress, Asos, Twitter (X), LinkedIn Learning, and more.

-

There is no need to hold a dollar account or convert Naira to foreign currency before making international purchases.

How Much Can You Spend?

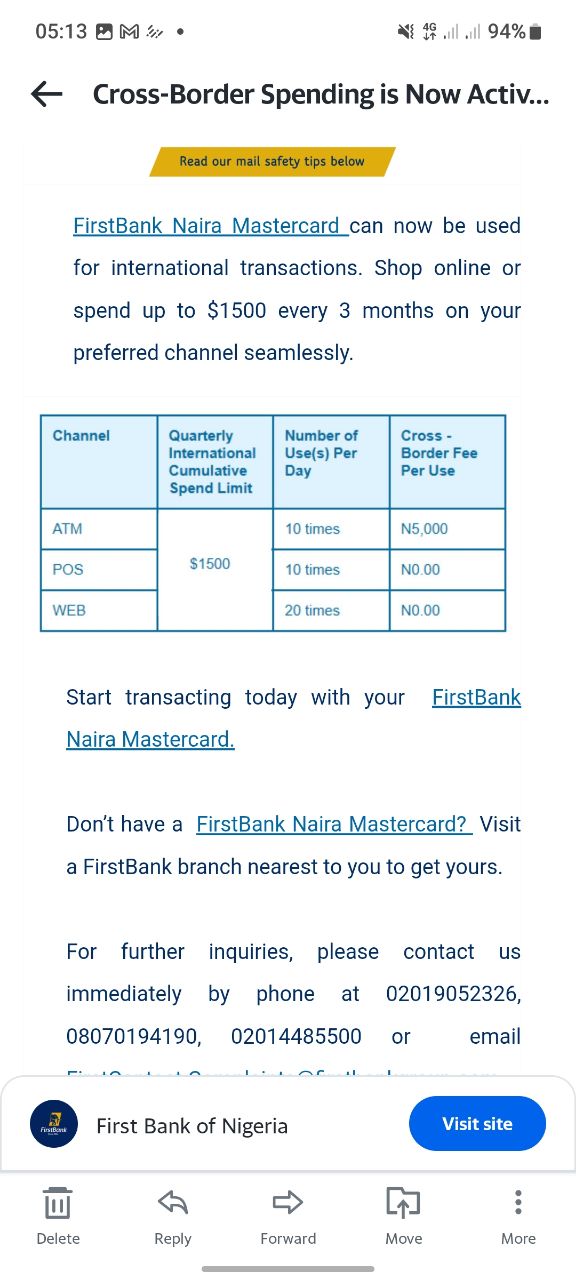

FirstBank has set a quarterly international spend limit of $1,500 (every 3 months).

Here are the details:

| Channel | Quarterly Spend Limit | Number of Uses per Day | Cross-Border Fee |

|---|---|---|---|

| ATM | $1,500 | 10 times | ₦5,000 per use |

| POS | $1,500 | 10 times | ₦0 |

| Web | $1,500 | 20 times | ₦0 |

Note: This applies to FirstBank Platinum and Classic Naira MasterCard holders.

How to Use Your FirstBank Naira MasterCard for International Purchases

- Ensure you have a FirstBank Naira MasterCard (Platinum or Classic).

- Activate international usage by confirming your card is enabled via:

- FirstMobile App

- USSD Code:

*894#(Card-in-Control Service)

- Fund your account with enough Naira to cover the purchase and the prevailing exchange rate.

- Use your card on any international website, streaming service, or POS machine abroad.

How to Apply for a FirstBank Naira MasterCard

If you don’t have a card yet:

- Visit any FirstBank branch to apply.

- Alternatively, request through FirstMobile App or FirstBank’s internet banking platform.

Key Benefits

- No need for dollar cards or domiciliary accounts.

- Shop globally from Nigeria with just your Naira account.

- Pay for subscriptions (Netflix, Spotify, LinkedIn, Microsoft, etc.) seamlessly.

- Daily ATM withdrawals abroad allowed (up to 10 times per day).

Security Tips

- Never share your card PIN, OTP, passwords, or card details with anyone.

- FirstBank will never ask you for confidential information.

- Report suspicious calls, emails, or messages immediately to:

- 08070194190 / 02014485500

- firstcontactcomplaints@firstbankgroup.com

Conclusion

With this update, FirstBank customers can now enjoy the convenience of global spending straight from their Naira accounts. This is a big step forward for international shopping, subscriptions, and travel-related payments.

Ready to start? If you already own a FirstBank Naira MasterCard, activate international spending today and enjoy seamless global transactions. If not, visit the nearest FirstBank branch to get yours.

Do you want me to make this even more tutorial-style (step-by-step guide with screenshots), or should I create a blog-optimized version with SEO keywords like "How to use FirstBank Naira MasterCard for international transactions in Nigeria"?

Also, should we add a section on exchange rates and how the $1,500 quarterly cap works (with practical examples)?

You must be logged in to post a comment.