lets first start by defining what passive income is passive income is money earned with little or no effort on the part of the recipient, passive income can be tracked back to investment opportunities in this article we are going to look at the various ways of generating passive income these days.

there are various ways of generating passive income such as;

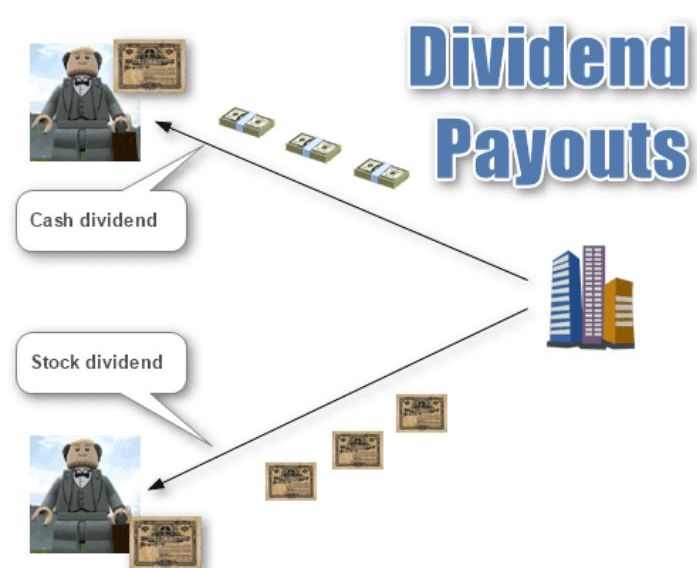

- investing in shares here you can generate money through capital gains or by dividends l personally could recommend investing in dividends shares as they are more safer as compared to investing in shares for capital gains but if you have the risk appetite go for it that's just my perspective dividends are either paid out once or twice a year after the company ends its financial year, capital gains come with risks such as market volatility or problems of liquidity in the share price, but the amount gotten if conditions are favorable is good.

investing for capital gains

- Investing in real estate here you either invest in bulling commercial plots and renting them out to the public or investing in REITS (real estate investment trusts) real estates that have already been developed you just invest your money into it maybe for their expansion or maintenance both ways are beneficial as they generate income for you , but also its good to understand the benefits and challenges of real estate;

BENEFITS CHALLANGES Property increases value over time high initial cost needed to start investing they offer steady and regular income high cost of maintenance of property leverage in financing as you can take loans against the property managing the property may be tiresome especially as a new investor commercial houses

REITS

- low risk investment vehicles this include MMFS (money market funds )and saccos though they do not offer extremely high returns they are a safer way of investing your money and here you can watch your money grow through the mathematical concept of compounding the main problem that you may face is inflation as they are heavily influenced by inflation, this majorly causes rates to fluctuate leading to low income generation.

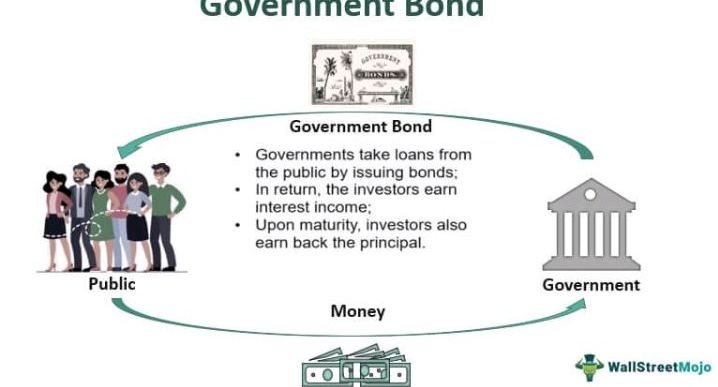

- Treasury bills and government bonds most people tend to confuse these two as one while actually they are two different entities, but all serve the same purpose to help us generate income am going to explain how they work and their differences

Treasury bills Government bonds usually short term don't last more than a year vary from 91,181to 364 days long term exceed one year time and can last up to 30 years treasury bills usually sold at a discount bonds are not sold at a discount profit is usually the amount you bought the bill and the amount at maturity bonds pay semiannual interest and principal at maturation listed on a monthly basis bonds are usually listed on a yearly basis bills are not affected by interest rate fluctuations due to shorter maturity bonds are affected by interest rate fluctuations due to longer maturation's  although bonds take longer they have higher chances of generating higher income than treasury bills. That's my take on passive income, NOTE this is not financial advice this knowledge is meant to broaden your intellectual capacity on ways of creating passive income.

although bonds take longer they have higher chances of generating higher income than treasury bills. That's my take on passive income, NOTE this is not financial advice this knowledge is meant to broaden your intellectual capacity on ways of creating passive income.

You must be logged in to post a comment.