How to Use FirstBank Naira MasterCard for International Transactions (2025 Update)

Are you a FirstBank customer in Nigeria? Good news – you can now use your FirstBank Naira MasterCard for international transactions again!

This means you can pay for subscriptions, shop on global e-commerce platforms, and even withdraw cash abroad without the need for a dollar card or domiciliary account.

In this guide, we’ll explain:

- What has changed with the FirstBank Naira MasterCard.

- How the $1,500 quarterly spending limit works.

- Step-by-step instructions to start using your card internationally.

Why Was the Naira MasterCard Restricted Before?

A few years ago, Nigerian banks were forced to block international transactions on Naira debit cards due to foreign exchange shortages.

- Customers couldn’t pay for Netflix, Spotify, or online courses.

- They had to open dollar accounts or find alternative payment methods.

Thankfully, FirstBank has now restored cross-border spending for its Platinum and Classic Naira MasterCard holders.

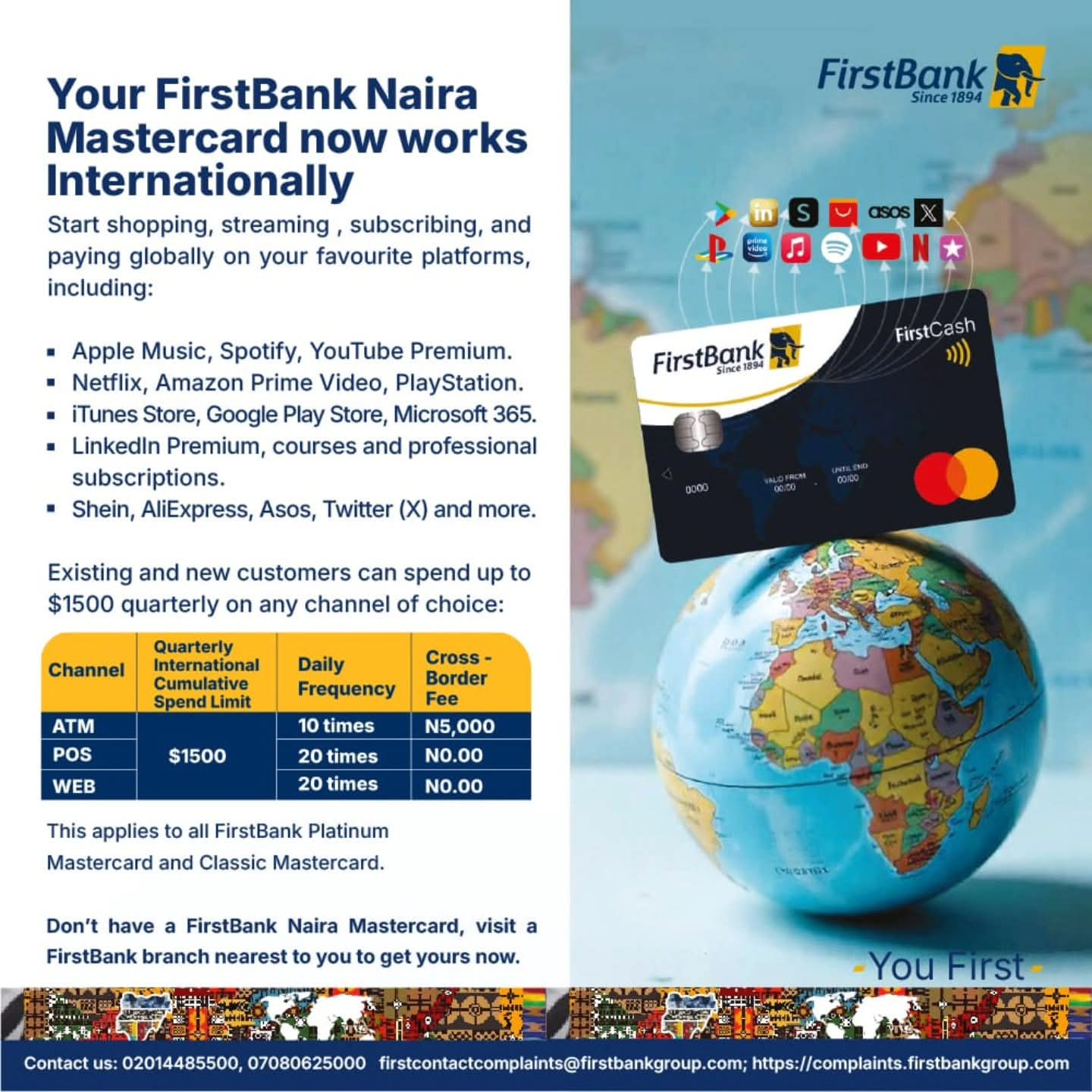

New Update: Your FirstBank Naira MasterCard Now Works Worldwide

You can now shop and pay on global platforms, including:

- Streaming services: Netflix, Spotify, YouTube Premium, Amazon Prime Video.

- Online stores: Shein, AliExpress, ASOS, Microsoft Store, Google Play, iTunes.

- Professional services: LinkedIn Learning, courses, and subscriptions.

- POS abroad: Use your card for shopping and dining outside Nigeria.

No dollar account needed! Payments are deducted directly from your Naira account at the current exchange rate.

How Much Can You Spend Internationally? ($1,500 Cap Explained)

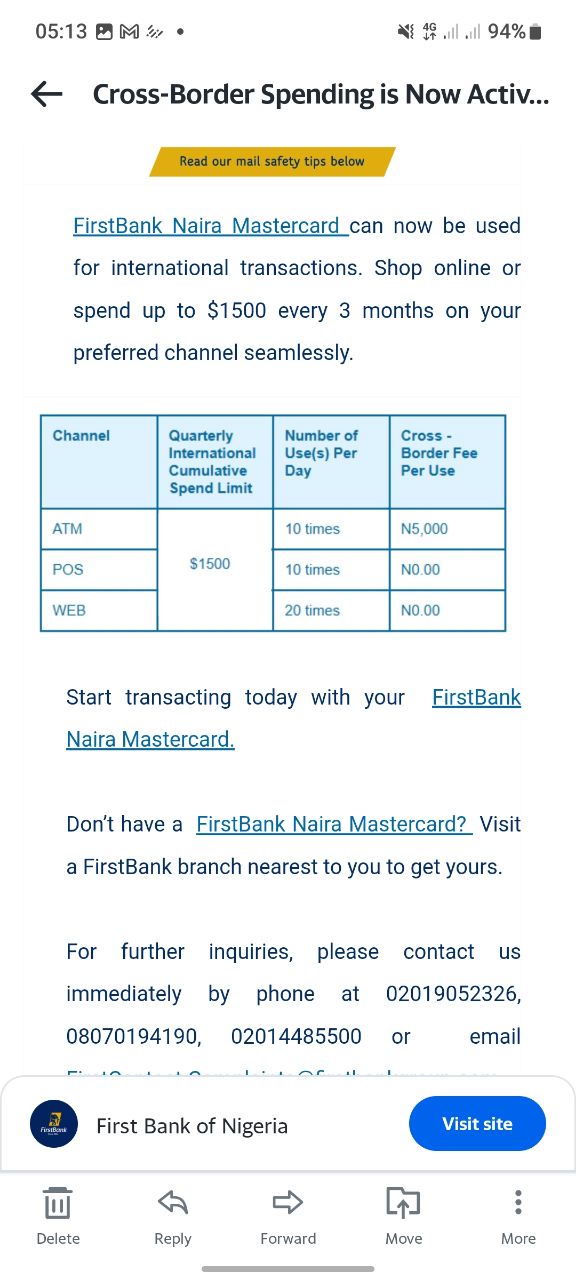

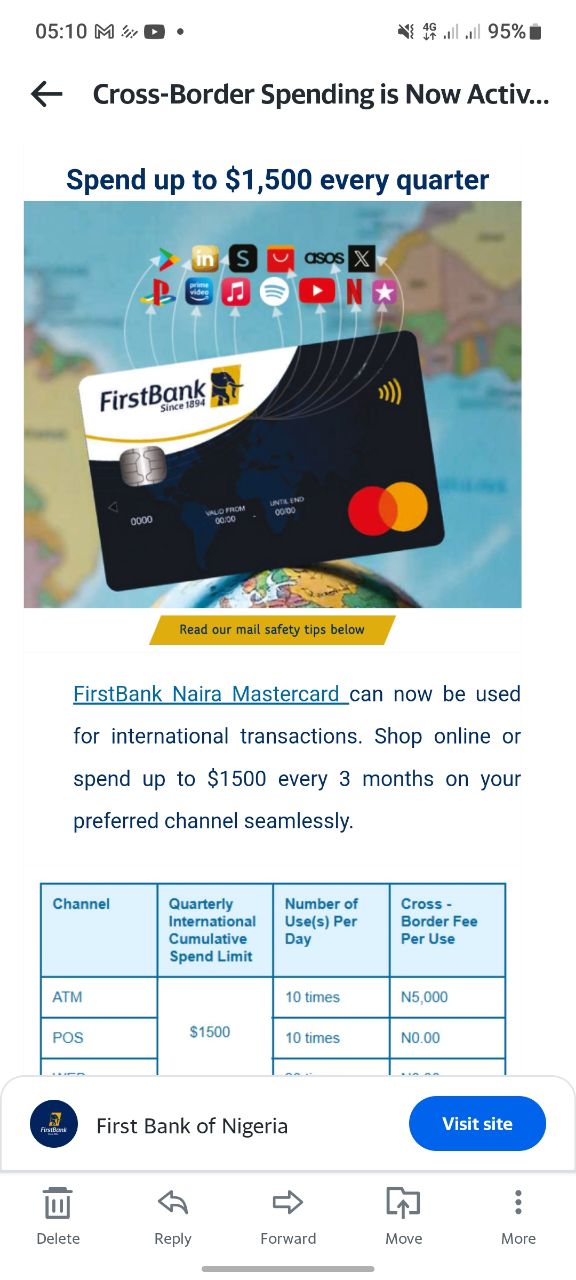

FirstBank allows you to spend up to $1,500 every 3 months (quarterly) using your Naira MasterCard.

Here’s how it works:

| Channel | Quarterly Spend Limit | Max Daily Transactions | Cross-Border Fee |

|---|---|---|---|

| ATM | $1,500 | 10 times/day | ₦5,000 per withdrawal |

| POS | $1,500 | 10 times/day | ₦0 |

| Web | $1,500 | 20 times/day | ₦0 |

Example:

If you buy items worth $600 on Amazon in January and pay for a $100 LinkedIn subscription in February, you would have $800 left from your quarterly $1,500 cap.

Once you reach the $1,500 limit, you must wait until the next quarter to continue using the card internationally.

Exchange Rate: How Are You Charged?

When you make a purchase in dollars, the amount is converted to Naira using FirstBank’s prevailing exchange rate (usually close to the official market rate plus a small markup).

Example:

- You buy a $50 subscription on Netflix.

- If FirstBank’s exchange rate is ₦1,600/$1, your account will be debited:

- $50 x ₦1,600 = ₦80,000.

How to Use Your FirstBank Naira MasterCard for International Payments (Step-by-Step)

- Check if you have a FirstBank Naira MasterCard (Platinum or Classic).

- If not, request one at the nearest branch or through the FirstMobile app.

- Activate international spending:

- Via the FirstMobile app or

- Using USSD

*894#(Card-in-Control service).

- Fund your account in Naira.

- Use your card on any international website, POS abroad, or ATM.

Benefits of the New Update

- Shop on popular international websites without restrictions.

- Pay for subscriptions easily (Netflix, Spotify, Apple Music, etc.).

- No need to operate a dollar card or domiciliary account.

- Withdraw cash abroad using ATMs.

Security Tips (Avoid Fraud)

- Never share your PIN, OTP, or card details with anyone.

- FirstBank will never ask for sensitive information by phone or email.

- Report suspicious activity immediately:

- Call 08070194190 / 02014485500

- Email firstcontactcomplaints@firstbankgroup.com

Conclusion

With the FirstBank Naira MasterCard now active for international transactions, you can enjoy the freedom of global payments straight from your Naira account.

If you already have the card, activate international usage today and start shopping worldwide. If not, visit any FirstBank branch to get yours.

You must be logged in to post a comment.