What It Does ?

PalmPay, a Central Bank of Nigeria-licensed mobile money app, offers:

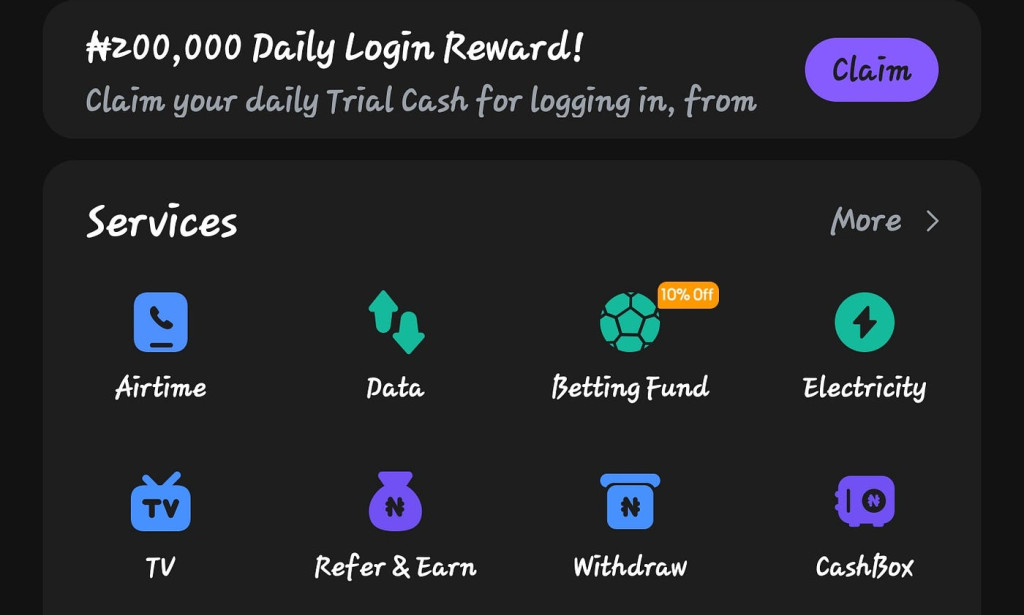

# Instant transfers, bill payments, airtime/data recharge, loans, insurance, and cashback rewards.

# Over 35 million users, 300 million monthly transactions, and pre-installation on Transsion phones (TECNO, itel, Infinix)

✅ Features That Stand Out

1. User-friendly interface – Simple, clean, and easy to use even for those new to it .

2. Cashback & referral rewards – New users receive ₦100+ worth of coupons; frequent use gets discounts & rewards.

3. Unbanked network of agents – 1 million merchants/agents enable cash-in/out for the unbanked.

4. Improved security – AI-powered fraud detection, device management, biometric login, end-to-end encryption .

Reviews & Complaints :

# AfricaCheck - warns against deceptive Facebook loan offers—not PalmPay services.

# TrustFinance - gets a moderate 3.4/5, with many users praising its ease of use and rewards.

# SundayAdoga review - complains of slow customer service and late refunds, but these were soon resolved.

# Nigerian forum warnings - refer to user error or scammer impersonation but are regarding agent fraud, not the genuine PalmPay app.

Verdict: Legit but Use With Caution :

PalmPay is a legitimate, CBN-licensed fintech app with robust capabilities and excellent usage in Nigeria. But users must:

* Download only the authentic app from Google Play/App Store.

* Ignore loan offers from fake "agents" on social media.

* Be prepared for occasional breakdowns in customer service or refunds.

You must be logged in to post a comment.