Non indemnity and indemnity insurance

As mentioned earlier, insurance business can be broadly classified into indemnity insurance and non indemnity insurance.in the case of indemnity insurance, the insurance company undertakes to indemnify (or compensate) the insured if the loss resulting from the insured against comes true.On the other hand, while the insurance company may pay a compensation in the case of non indemnity insurance, the aim is not to equate the compensation with the loss.

Types of non indemnity and indemnity insurance

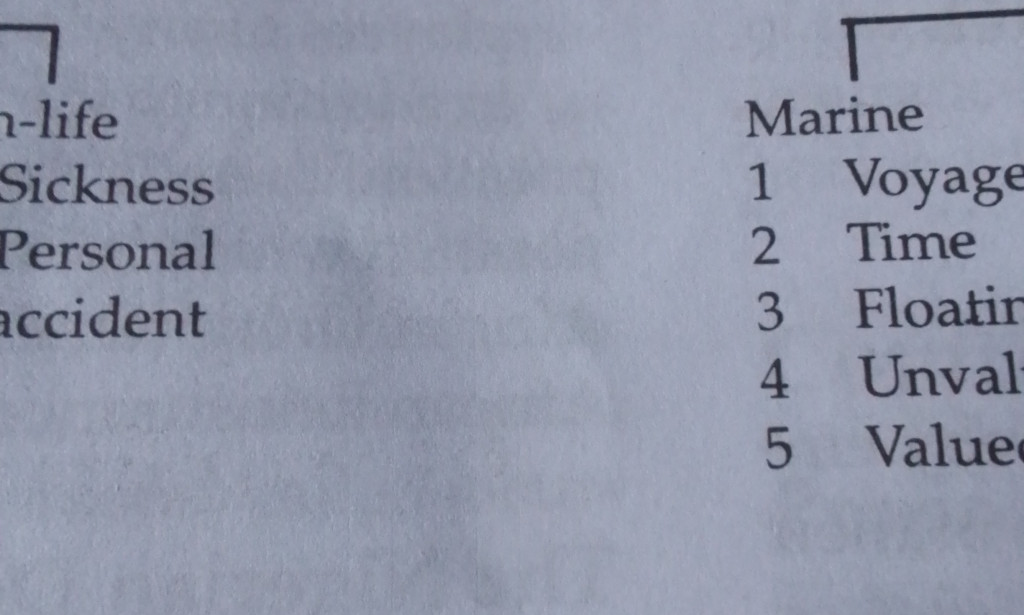

Non indemnity insurance consists of life insurance and non life insurance types.life insurance itself may be of whole life, endowment or term assurance.Non life insurance,on the other hand, is mostly in the form of sickness or personal accident insurance.

Types of indemnity insurance

Consists of marine insurance and others (fire ,theft and burglary, insurance of liability,etc). marine insurance consists of voyage, time, floating, valued and unvalued forms.

You must be logged in to post a comment.