Economic uncertainty is often painted as a threat — headlines warn of slowing growth, volatile markets, and cautious investors. Yet history tells a different story: periods of disruption are often breeding grounds for the next generation of business leaders and financial success stories.

From the global financial crisis of 2008 to the pandemic-driven shocks of 2020, some of today’s most valuable companies were born during times of instability. The difference lies in perspective, strategy, and adaptability.

---

The Opportunity in Uncertainty

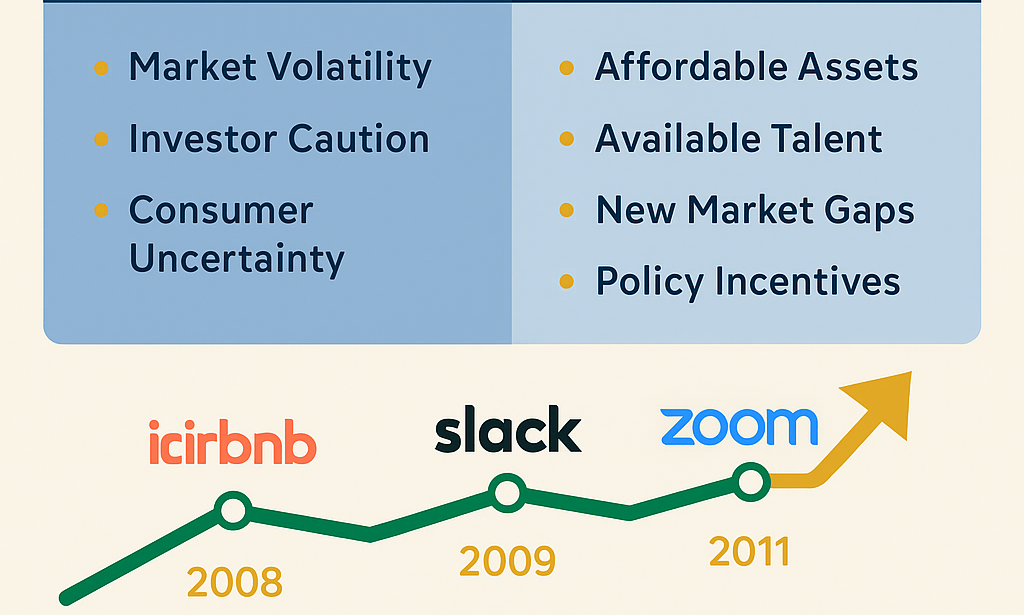

Recessions and market downturns may shrink demand in some areas, but they also create:

Lower entry barriers as competitors scale back

Talent availability due to layoffs and restructuring

Asset repricing that makes investments more affordable

Shifts in consumer behavior that open untapped markets

A recent study by the Harvard Business Review found that companies launched during economic downturns tend to have higher resilience and faster growth rates once the market stabilizes.

---

Investor Behavior: From Risk-Averse to Selective Risk-Taking

During volatile times, investors become more cautious — but not inactive.

Instead of chasing speculative hype, capital flows toward ventures with:

Strong fundamentals

Lean operating models

Clear problem-solving capabilities

Scalable potential

This selective environment rewards disciplined entrepreneurs who can clearly articulate value, not just vision.

---

Sectors Poised for Growth

Despite broader uncertainty, several industries are showing counter-cyclical growth:

1. Fintech & Digital Payments – Rising demand for contactless, global, and secure transactions

2. Green Energy & Sustainability – Policy incentives and corporate ESG commitments driving demand

3. Healthcare Technology – AI-driven diagnostics, telemedicine, and personalized care solutions

4. Supply Chain Innovation – Logistics tech addressing resilience and efficiency gaps exposed during recent crises

5. Affordable Luxury & Value Retail – Brands offering premium feel at budget-friendly prices

---

Leadership Traits That Thrive in Uncertain Times

Business leaders who succeed in turbulent markets tend to share specific qualities:

Agility – Ability to pivot strategies based on real-time data

Financial Discipline – Strong cash flow management and prudent capital allocation

Vision Anchored in Reality – Balancing ambition with market awareness

Courage to Invest When Others Retreat – Leveraging downturns to build long-term advantage

As Warren Buffett famously advises: “Be fearful when others are greedy, and greedy when others are fearful.”

---

Case Studies: Success Born in Crisis

Airbnb (2008) – Launched during the global financial crisis, capitalizing on the demand for affordable travel

Slack (2009) – Pivoted from gaming to workplace communication when the market signaled a bigger opportunity

Zoom (2011) – Built for remote collaboration long before it became essential in 2020

Each company identified emerging pain points and acted swiftly, proving that adaptability often outweighs initial resources.

---

Practical Steps for Entrepreneurs and Investors

1. Focus on Core Value Creation – Address real, urgent problems

2. Strengthen Financial Foundations – Maintain healthy liquidity and reduce unnecessary overhead

3. Leverage Strategic Partnerships – Share risk and tap into complementary expertise

4. Stay Data-Driven – Monitor economic indicators and industry-specific trends

5. Build for Long-Term Resilience – Avoid short-term gimmicks; aim for sustainable advantage

---

Conclusion

Economic uncertainty is not the enemy — complacency is. In every market shift, there are those who retreat and those who rise. The leaders of tomorrow will be those who see beyond the fear, recognize the openings, and act with calculated boldness.

> The next market boom may already be in motion — the question is, will you be ready to seize it?

---

📌 Key Takeaways:

Downturns create unique opportunities for well-prepared leaders and investors

Selective, disciplined strategies outperform speculative risk-taking

Emerging sectors like fintech

, green energy, and healthcare tech are primed for growth

Resilience, adaptability, and vision are the ultimate competitive advantages

You must be logged in to post a comment.