In this comprehensive review, we delve into the intricacies of Pension Funds, a platform claiming to offer high returns through task-based investment and a referral program. We will scrutinize its investment plans, explore the features it boasts, and evaluate the viability of its referral program. Additionally, we'll examine the withdrawal process, the tasks section, and scrutinize the provided information on safety and security. As red flags have been raised about the platform's legitimacy, we'll thoroughly assess these concerns and provide insights to help you make an informed decision regarding Pension Funds. Join us as we dissect the platform's offerings and potential risks to unveil a clearer understanding of its operations.

Pension Funds Review:

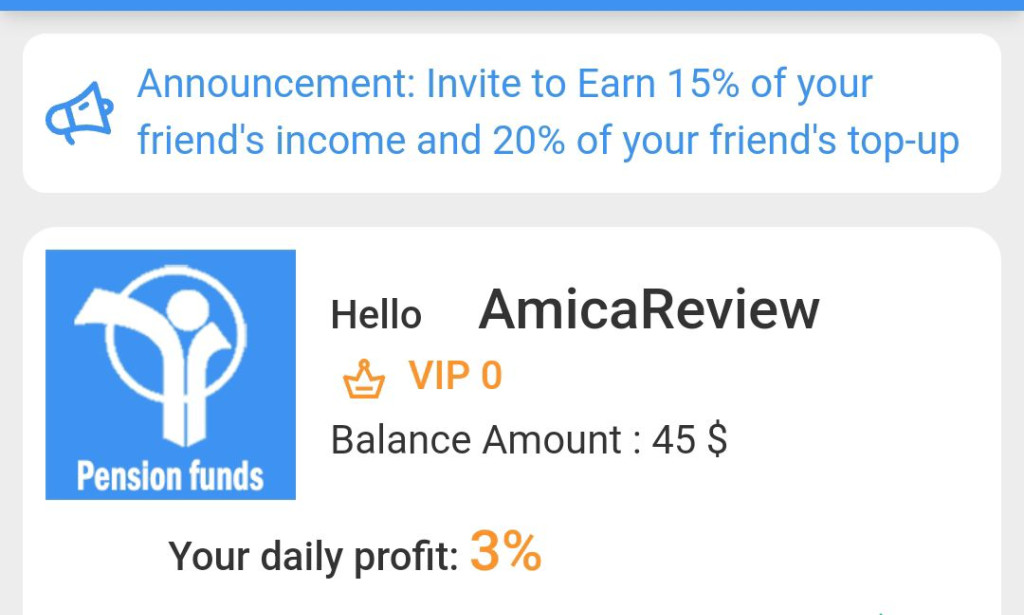

Pension Funds or pension-funds.org claims to be a task-based investment and referral program, touting itself as the world's first platform to automate trading on exchanges through technology. Here's a detailed review of its features, referral program, withdrawal process, deposit overview, and overall functionality.

Overview:

Pension Funds positions itself as a lucrative investment opportunity, boasting the highest returns in 2023. It offers a range of VIP investment plans, claiming daily profits ranging from 18% to 50%.

How It Works:

Users are encouraged to deposit funds, with higher investments promising higher daily profits. The platform supposedly engages in Cryptocurrency and Forex Trading to generate returns.

Features:

- Easy to Use: Pension Funds prides itself on being the largest foundation globally, with over $10 billion in reserves. Users can earn daily income without actively managing their funds.

- Safety: Marketed as the safest asset amid global tensions, it emphasizes a hands-off approach to investing.

- Daily Withdrawals: Withdrawals are touted as simple and fast, allowing users to reinvest or cash out their interest daily.

Investment Plans Overview:

Pension Funds offers a range of investment plans targeting different levels of investors, each with varying daily profit percentages. Here's a detailed breakdown of the available investment plans:

- 1. VIP1:

- - Daily Profit: 18%

- - Minimum Investment: $100

- - Maximum Investment: $2,500

- - Withdrawal: Quick withdrawal

- - Support: 24/7 support

- 2. VIP2:

- - Daily Profit: 30%

- - Minimum Investment: $3,000

- - Maximum Investment: $8,000

- - Withdrawal: Quick withdrawal

- - Support: 24/7 support

- 3. VIP3:

- - Daily Profit: 40%

- - Minimum Investment: $8,500

- - Maximum Investment: $15,000

- - Withdrawal: Quick withdrawal

- - Support: 24/7 support

- 4. VIP4:

- - Daily Profit: 50%

- - Minimum Investment: $15,001

- - Maximum Investment: Unlimited

- - Withdrawal: Quick withdrawal

- - Support: 24/7 support

Investment Philosophy:

Pension Funds describes its investment philosophy as a differentiated credit-focused franchise. It combines relative value trading with a deep understanding of fundamental credit investing and legal and structuring expertise. The emphasis is on risk management, and the platform opportunistically invests across the capital structure in less efficient market segments with the goal of generating consistent, alpha-driven returns across market cycles.

Focus:

The platform highlights its global investment strategy, seeking to build a concentrated portfolio of scale investments in industries it claims to know well and have developed significant expertise.

Additional Information:

- The platform claims to have over $10 billion in reserves.

- Users can start earning without actively managing their funds.

- Pension Funds positions itself as a safe haven amid global tensions and conflicts.

While the investment plans promise attractive daily profits, users should approach them with caution given the lack of transparency regarding the platform's leadership and income sources. Thorough research and due diligence are recommended before considering any investment.

Tasks Section Overview:

Pension Funds incorporates a task-based system to provide users with opportunities to earn additional bonuses. Here's an in-depth look at the tasks section:

1. Task Structure:

Users are presented with a series of tasks, each accompanied by a reward. These tasks are designed to be completed carefully to ensure users receive the stated bonuses. It's emphasized that failure to complete tasks carefully may result in deductions from winnings or even account disablement in serious circumstances.

2. Types of Tasks:

The tasks seem to be diverse, each labeled from "task 1" to "task 5." While the specific nature of the tasks is not detailed, completion is crucial for users to earn the associated bonuses.

3. Task Rewards:

Completing each task successfully is rewarded with a bonus of $5. The cumulative completion of tasks contributes to users' overall earnings on the platform.

4. Sign-Up Bonus:

Upon registering on the platform, users are offered a sign-up bonus of $35, providing an initial boost to their account balance.

5. Additional Rewards:

Apart from task-based earnings, the platform encourages users to reach a specific target number of invitations to receive corresponding bonuses. These bonuses are not detailed in the provided information but are implied to be additional incentives for user engagement.

6. Task Care and Caution:

Users are explicitly warned to complete tasks carefully. The platform underscores the importance of meticulous task completion to avoid potential deductions from winnings and, in severe cases, the disabling of user accounts.

7. Fraud Prevention:

Pension Funds expresses a strong stance against fraud, with an anti-fraud detection system in place. If the system detects illegitimate or falsely registered users, the account is stated to be banned immediately.

The tasks section in Pension Funds serves as a means for users to increase their earnings beyond the investment plans. However, users should exercise caution and diligence in completing tasks to avoid potential penalties or account disablement. As with any feature on the platform, thorough research and understanding of the terms and conditions are recommended to ensure a positive and secure user experience.

Referral Program Overview:

Pension Funds offers a referral program to incentivize users to bring in new participants. Here's a brief overview:

1. Commission Structure:

- - Users can earn commissions by inviting friends to join the platform.

- - Commission rates are specified for both friends' top-ups and their daily earnings.

2. Commission Rates:

- - Commission for friend's top-up: 20%

- - Commission for friend's daily earnings: 15%

3. No Cap on Earnings:

There is no specified cap on the earnings users can receive through the referral program. The more friends a user invites and the more they earn, the more commission the referring user can receive.

4. VIP Level Upgrades:

Users can potentially upgrade their VIP level for free within 48 hours if they reach a certain number of invitations. The specific number is not provided in the available information.

5. Additional Benefits:

- - Inviting friends to form an agency team is highlighted as a lucrative way to make money.

- - Users can earn $100 upon reaching a specific invitation goal.

6. Anti-Fraud Measures:

The platform emphasizes a strong stance against fraud and has an anti-fraud detection system in place. Users are warned that accounts engaging in false recommendations may be banned.

7. Sign-Up Bonus for Referrals:

Users receive a $1 bonus when friends they invite successfully sign up.

Pension Funds' referral program offers users the opportunity to earn commissions by inviting friends, with additional benefits such as VIP level upgrades and sign-up bonuses. However, users are cautioned against engaging in fraudulent activities, and the platform employs measures to detect and prevent such behavior. As always, users should be mindful of the terms and conditions associated with the referral program and conduct due diligence before participating.

Withdrawal Method Overview:

Pension Funds provides users with a withdrawal system to access their earnings. Here's a detailed overview of the withdrawal process, methods, and related information:

1. Minimum Withdrawal Amount:

The minimum withdrawal amount on Pension Funds is set at $100. Users can initiate withdrawals once their earnings reach or exceed this threshold.

2. Withdrawal Processing Time:

Withdrawals are claimed to be processed within 48 hours of submission for review. This suggests that users can expect their requested withdrawals to be completed within this specified timeframe.

3. Handling Fee:

Pension Funds imposes a 2% handling fee on withdrawals. Users should be aware of this fee when planning their withdrawals, as it will be deducted from the requested amount.

4. Supported Payment Methods:

The platform offers a variety of payment methods for withdrawals, including:

- - Opay

- - USDT (TRC20)

- - Bitcoin (BTC)

- - Venmo

- - Cash App

- - PayPal

- - Skrill

- - And more (19 ways withdrawal method)

5. Payment Information and Security:

Users are instructed to enter their password during the withdrawal process. It is emphasized that once the withdrawal is successful, the payment process cannot be reversed. Additionally, users are advised to ensure that the USDT address provided is correct.

6. Withdrawal Certificate:

After a successful withdrawal, users are instructed to send the withdrawal certificate to the group or friends. This step adds an extra layer of confirmation to the withdrawal process.

Domain Information:

The platform's domain, pension-funds.org, is registered with Namesilo, LLC, and is set to expire on September 15, 2024. The latest update on the domain was on September 2, 2023.

While Pension Funds provides multiple withdrawal options and a relatively quick processing time, users should be mindful of the 2% handling fee and ensure the accuracy of their withdrawal information.

Deposit or Recharge Overview:

The minimum deposit is $5, and users can recharge via USDT (TRC20), TRX (TRC20), or BTC.

Claims and Transparency:

Pension Funds asserts to have over 790,000 active users, an average monthly pay of $10,000 for members, and secure payments totaling 56 million. However, it lacks transparency regarding its CEO, office location, and the source of its income.

launched date:

The platform was launched around November 2nd, 2023. Its domain, pension-funds.org, is registered with Namesilo, LLC, and its CEO, office location, and income sources are unknown.

User Registration Guide:

- 1. Sign Up:

- - Visit the registration page: [Pension Funds Registration (https://pension-funds.org/register.php)

- - Enter a new username of your choice.

- - Provide your email address.

- - Create a new password and confirm it.

- - Enter any invitation code if applicable.

- - Click on "Continue" to proceed with the registration process.

- 2. Sign In:

- - To log in, go to the login page: [Pension Funds Login (https://pension-funds.org/login.php)

- - Enter either your username or email in the designated field.

- - Input your password.

- - Click on "Continue" to log in to your account.

Note:

- - Ensure that the information provided during the registration process is accurate.

- - If you have received an invitation code, use it for potential bonuses or access.

- - Keep your login credentials secure and avoid sharing them with others.

- - If you encounter any issues during registration or login, refer to the platform's support or contact information for assistance.

Important Security Tips:

- - Choose a strong and unique password for your account.

- - Enable two-factor authentication if the platform offers this security feature.

- - Regularly update your password for added security.

Disclaimer:

Exercise caution and conduct thorough research before participating in any online platform. Verify the legitimacy of Pension Funds and be aware of potential risks associated with investment programs. Additionally, review and adhere to the platform's terms and conditions during the registration and login processes.

Telegram-Based Customer Support:

Pension Funds offers customer support through Telegram. Users can reach out for assistance, though the identity of the support staff remains unknown. Response times may vary, and users are advised to utilize this channel for inquiries. Exercise caution and refer to the platform's official resources for support.

Download Pension Funds App:

For convenient access to Pension Funds, users can download the app via the provided APK link:

Download Link:

- The APK file for the app can be obtained through the following link: [Pension Funds App (https://pension-funds.org/apk/pensionfunds.apk).

Installation Steps:

- 1. Click on the download link to initiate the APK file download.

- 2. Once downloaded, locate the file on your device.

- 3. Enable installation from unknown sources in your device settings.

- 4. Open the APK file to begin the installation process.

- 5. Follow on-screen instructions to complete the installation.

Note:

- - Exercise caution when downloading APK files from external sources.

- - Ensure your device security settings allow installation from unknown sources.

- - Always use the official platform link to download the app to mitigate potential security risks.

The download section provides a direct link to the Pension Funds app, allowing users to access the platform conveniently. Follow the provided steps carefully to install the app on your device for a seamless user experience.

Red Flags Warning:

Investors should be wary of several red flags associated with the Pension Funds platform, signaling potential risks and legitimacy concerns:

1. Lack of Transparency: - The platform conceals crucial information, such as the identity of its CEO, office location, and the source of its income. Transparency is a key element of trustworthy investment platforms.

2. Unspecified Revenue Generation: - Pension Funds fails to clarify how it generates funds to fulfill the promised rewards. The absence of a clear and legitimate income source raises suspicions about the sustainability of the platform.

3. Missing Payment Proof: - As of now, there is no credible evidence or valid payment proof showcasing successful transactions on the platform. The lack of transparent financial transactions is a significant concern.

4. Ponzi-Like Characteristics: - The structure and operation of Pension Funds exhibit similarities to Ponzi schemes, where returns are paid from new investors' funds rather than legitimate profits. This model is unsustainable and poses risks to investors.

5. Unknown CEO and Office Location: - The undisclosed identity of the CEO and the absence of a physical office location in any country contribute to the platform's lack of credibility. Legitimate investment platforms typically provide clear information about their leadership and physical presence.

6. Unknown Source of Income:

- Pension Funds does not disclose its source of income, leaving users in the dark about how the platform sustains its operations and rewards. A legitimate investment platform should be transparent about its revenue streams.

7. Potential Unsustainability: - The combination of undisclosed information, lack of transparency, and Ponzi-like characteristics raises concerns about the long-term sustainability of Pension Funds. Platforms with similar traits have a higher risk of collapse.

Given the multiple red flags observed, potential investors are strongly advised to exercise extreme caution and reconsider engagement with Pension Funds. Prudent financial decisions involve thorough research, transparency, and a clear understanding of the risks involved. Consider reputable and transparent investment opportunities with verifiable track records to mitigate potential losses.

Is Pension Funds a scam or a legit website?

Considering the undisclosed aspects of the platform and the absence of verifiable payment proofs, users are strongly advised to exercise extreme caution. The characteristics observed suggest a potential Ponzi-like structure, indicating a higher risk of financial loss. Be cautious and consider alternative investment opportunities with a proven track record and transparent operations. Always conduct thorough research and consult financial experts before engaging with such platforms.

Conclusion:

Pension Funds presents an enticing investment opportunity with substantial claims of daily profits and a referral program. However, its lack of transparency regarding leadership and income sources raises concerns about its legitimacy. Users should exercise caution and conduct thorough research before investing in such platforms.

You must be logged in to post a comment.