SaveBox.biz is a Nigerian investment platform that has been gaining popularity lately due to its high yield and referral bonuses. While many users have reported success stories with SaveBox.biz, it is important to consider the risks involved before investing any amount of money.

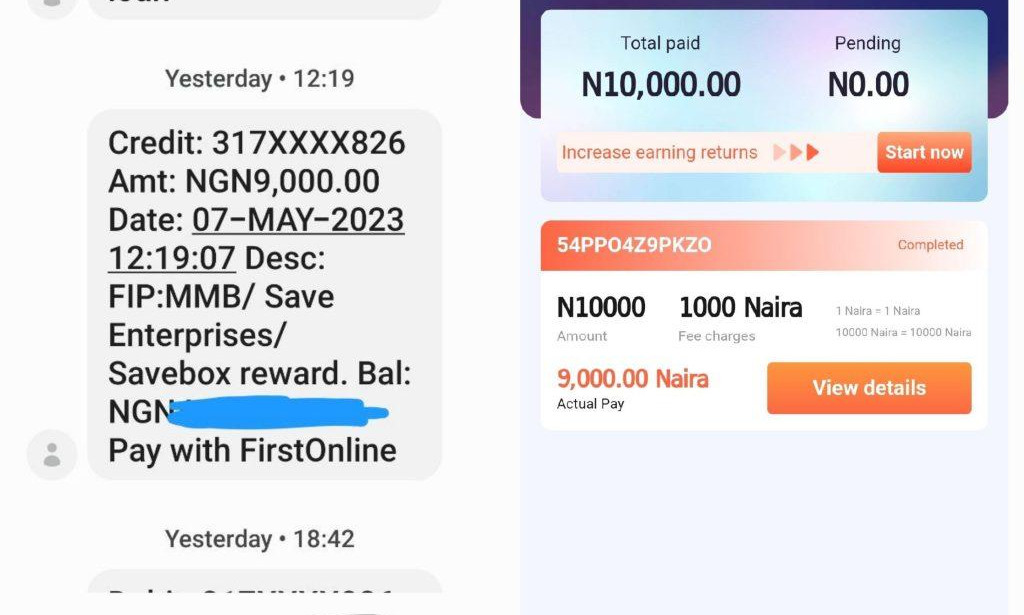

As an investor, it is essential to do proper research before investing in any platform. This includes reading reviews, checking for payment proofs, and understanding the platform's terms and conditions. In the case of SaveBox.biz, there have been several reports of successful payments, which is a positive sign. However, users must still be cautious and invest only what they can afford to lose.

It is also important to note that SaveBox.biz operates like any other investment platform, and there are no guarantees of profits. While some users have made significant returns, others have lost their investments. Therefore, it is necessary to have a clear investment plan and stick to it. Also READ SAVE BOX NG FULL REVIEW

Another key consideration is the referral program offered by SaveBox.biz. While it may be tempting to refer as many people as possible to increase your referral bonus, it is important to ensure that you are referring genuine users who are also willing to invest. Referral fraud is a common issue in many investment platforms, and it can lead to the suspension of your account.

When investing in SaveBox.biz or any other investment platform, it is necessary to diversify your investments. Putting all your money in one platform is risky as it can lead to significant losses if the platform fails. Therefore, it is recommended to spread your investments across several platforms and investment options.

While SaveBox.biz has been proving to be a successful investment platform for some users, there are risks involved. Investors must do their due diligence and invest only what they can afford to lose. Diversifying investments and referring genuine users are also necessary strategies for successful investing. By following these guidelines, investors can maximize their chances of success while minimizing the risks involved.

The Cost of Greed: The Devastating Consequences of Ponzi Schemes

Ponzi schemes have been around for almost a century, and they continue to plague unsuspecting investors. The name Ponzi comes from Charles Ponzi, an Italian immigrant who promised investors in the 1920s that he could deliver high returns on their investments by buying and selling international reply coupons. Ponzi's scheme eventually collapsed, leaving investors with nothing. Despite the fact that Ponzi schemes have been exposed time and time again, new Ponzi-like schemes continue to pop up, and unsuspecting investors continue to fall prey to them.

The Pros and Cons of Ponzi-like Schemes

At first glance, Ponzi-like schemes like savebox.biz may seem like an attractive investment opportunity. They promise high returns on investments and often require little to no effort on the part of the investor. However, there are several drawbacks to these types of schemes that investors need to be aware of.

One of the main drawbacks of Ponzi schemes is that they are illegal. Ponzi schemes are a form of fraud and are considered a white-collar crime. If you get caught up in a Ponzi scheme, you could face legal consequences, including fines and jail time.

Another downside to Ponzi schemes is that they are unsustainable. Ponzi schemes rely on the constant recruitment of new investors to pay off earlier investors. As soon as the flow of new investors dries up, the scheme collapses, and investors lose their money.

Investors in Ponzi schemes also have little to no control over their investments. They are often promised high returns, but they have no say in how their money is invested. This lack of control can be risky, especially if the scheme's operators make poor investment decisions.

The Advantages of Ponzi-like Schemes

Despite their drawbacks, Ponzi-like schemes do have some advantages that make them attractive to investors. One of the main advantages is that they offer the potential for high returns. In some cases, investors can double or triple their money in a short period of time. While these returns may seem too good to be true, they are often enough to lure in unsuspecting investors.

Another advantage of Ponzi-like schemes is that they are often easy to participate in. Investors can sign up online, and there are often no minimum investment requirements. This ease of use makes these schemes appealing to those who are new to investing or who are looking for a quick and easy way to make money.

What to Consider Before Investing

Before investing in a Ponzi-like scheme like savebox.biz, there are several things investors should consider. First and foremost, investors should do their research. They should investigate the scheme's operators, read reviews, and search for news articles about the scheme. If the scheme's operators are not transparent about how they make their money or are reluctant to provide information, investors should be wary.

Investors should also consider the risks involved. They should never invest more than they can afford to lose, and they should be prepared for the possibility that they may lose all of their investment. It is also important to consider the legality of the scheme. If the scheme's operators are not licensed to offer investments, investors should stay away.

In Conclusion

Ponzi-like schemes like savebox.biz may seem like an attractive investment opportunity, but investors should be wary. These schemes are often illegal, unsustainable, and offer little to no control over investments. While they do offer the potential for high returns, investors should consider the risks involved and never invest more than they can afford to lose.

You must be logged in to post a comment.